how to calculate epf contribution

Thats a huge amount. Hence the wages on which contribution is made is capped to the limit of Rs.

Epf Pension Calculator Epf Pension Calculator Released Know How To Calculate Pension Rightsofemployees Com

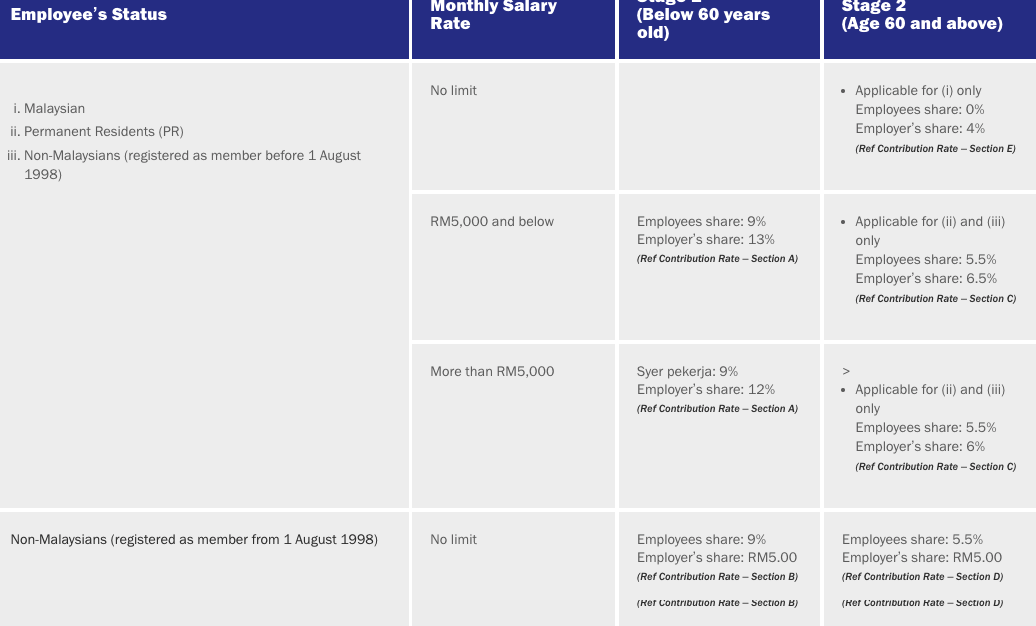

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

. The 12 of the employer contribution is usually divided as follows. Upon retirement you will keep your savings invested with 4 default rate of return pa. EPF Form 11 is submitted when the employee switches his jobs for transferring the EPF amount from the previous account to the new account.

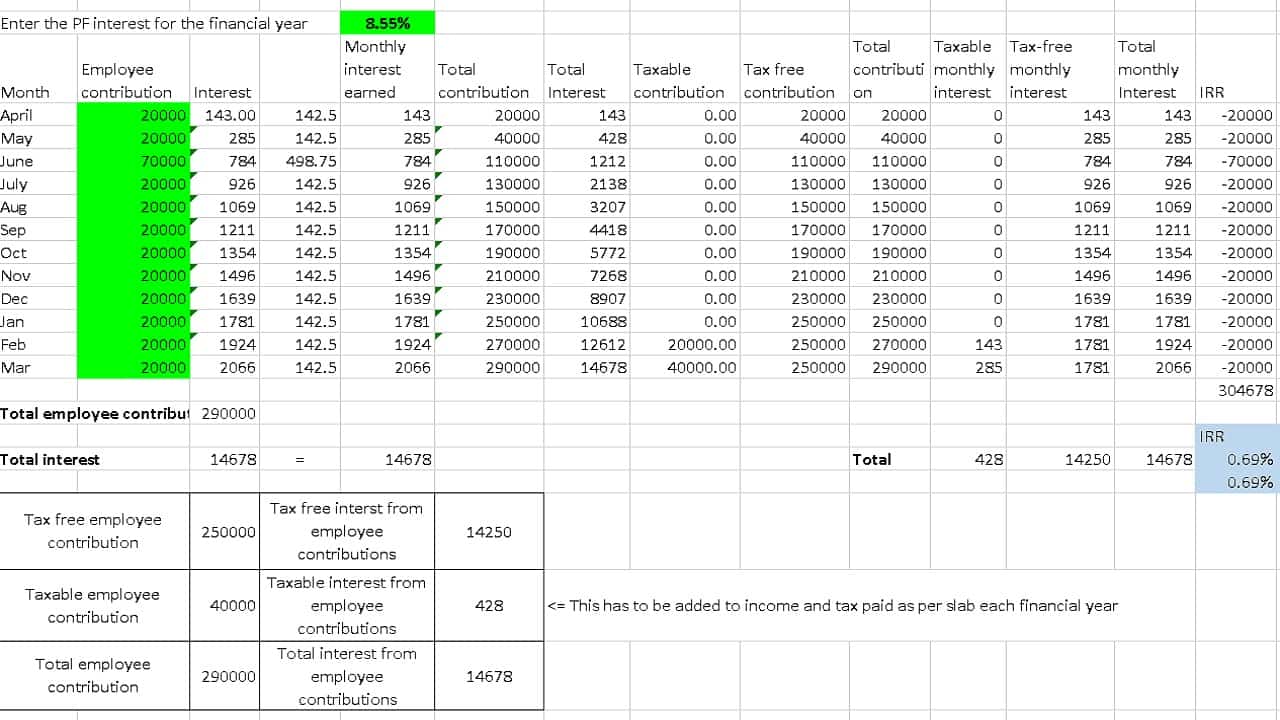

The Central Board of Direct Taxes CBDT has on August 31 2021 notified the rules regarding the taxation of the interest on the excess EPF contributions. It was announced in Budget 2021 that interest on Employees Provident Fund EPF and Voluntary Provident Fund contributions above Rs 25 lakh in a financial year will be taxable. The reasons for not claiming EPF Scheme benefits can be due to ignorance negligence on part of the EPF members procedural delays by the EPFO or no-claim made by the nomineeslegal-heirs after the death of the subscribers.

The Employees Provident Fund calculator will help you to estimate the EPF amount you will accumulate at the time of retirement. Service charges tips etc Overtime payments. According to the scheme a part of the employer contribution towards the provident fund goes to the pension scheme.

Admin Charges for Employer. Gain peace of mind as our EPF table PCB calculation and EPF contribution rates are updated and accurate as of EPF 2021. Here are some interesting advantages of using an EPF calculator online.

Employers are not allowed to calculate the employers and employees share based on exact percentage EXCEPT for salaries that exceed RM2000000. The EPF pension is something that a person receives after the end of hisher service period in an organization that has to be 10 or more than 10 years. And make monthly withdrawal of an amount that you will need.

Life time EPF savings average at default 4 dividend rate per annum. What is the calculator about. You do not have to manually calculate your total contributions each time.

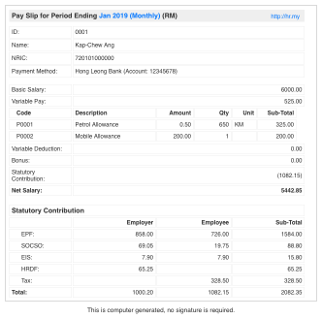

How to use it To arrive at the retirement corpus you need to enter few details such as. Calculate your salary EPF 2021 PCB and other income tax amount online with this free EPF calculator and EPF table. Identify the Terms Conditions to Calculate PCB Where to deduct the PCB amount from.

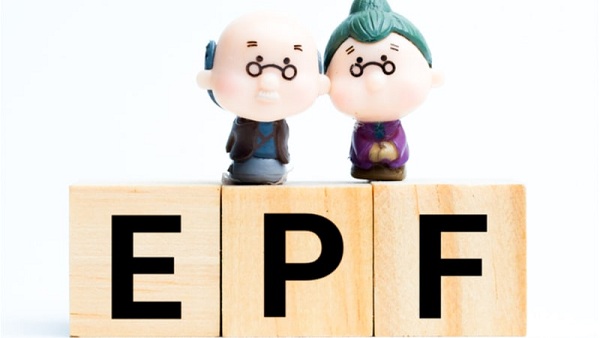

Gratuity payment to employee payable at the end of a service period or upon voluntary resignation Retirement benefits. As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF. Each month an employee has to part with 12 of their basic pay together with a Dearness allowance.

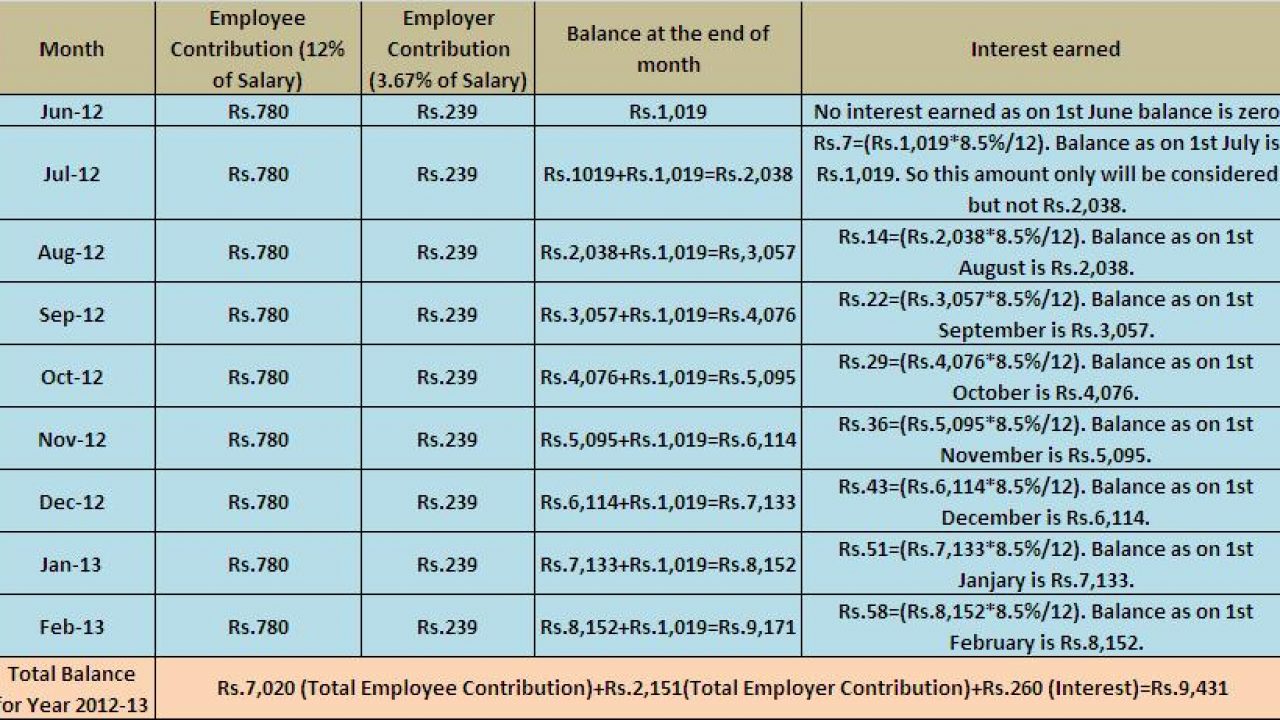

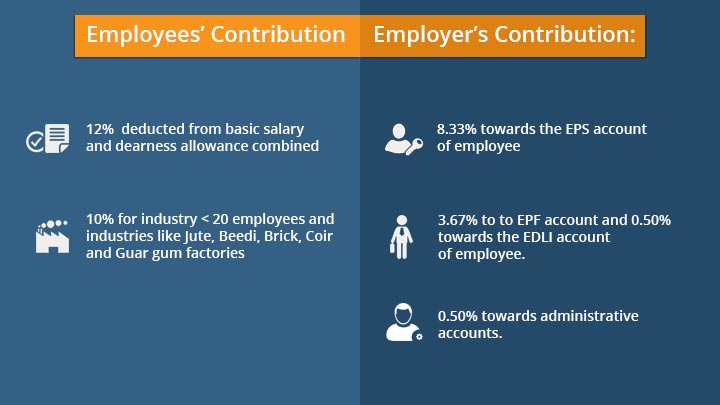

Now we can calculate the EPF contribution in the following ways. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. A sum of Rs 27000 crore is lying as unclaimed amount in the EPF accounts.

This move will make it easy to calculate the tax to be paid on my interest accrued. The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. Maximum RM 4000 relief per year.

EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952. Your present age and the age when you wish to retire. Your employers contribution to your EPF is also tax-free.

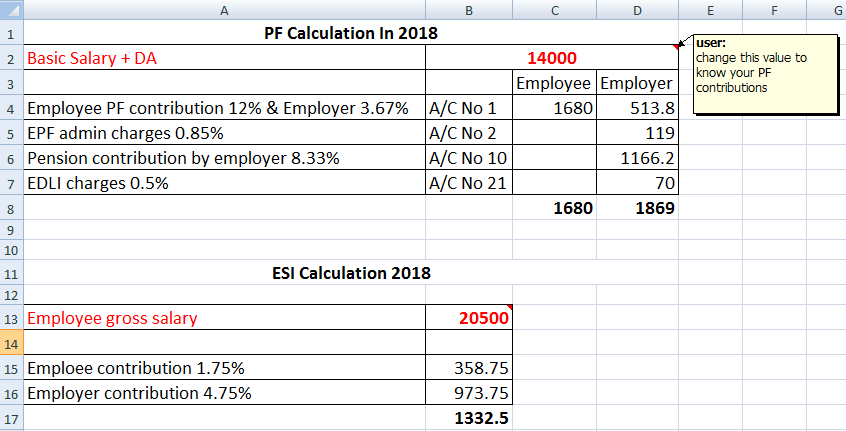

Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only Remaining amount wil go to Difference. According to the notification for the. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

A 10 rate is applicable in the case of establishments with less than 20 employees sick units or. The Employees Provident Fund EPF calculator will help you to calculate the amount of money you will accumulate on retirement. You do not have to worry if the interest rates or contribution ratios vary over a period.

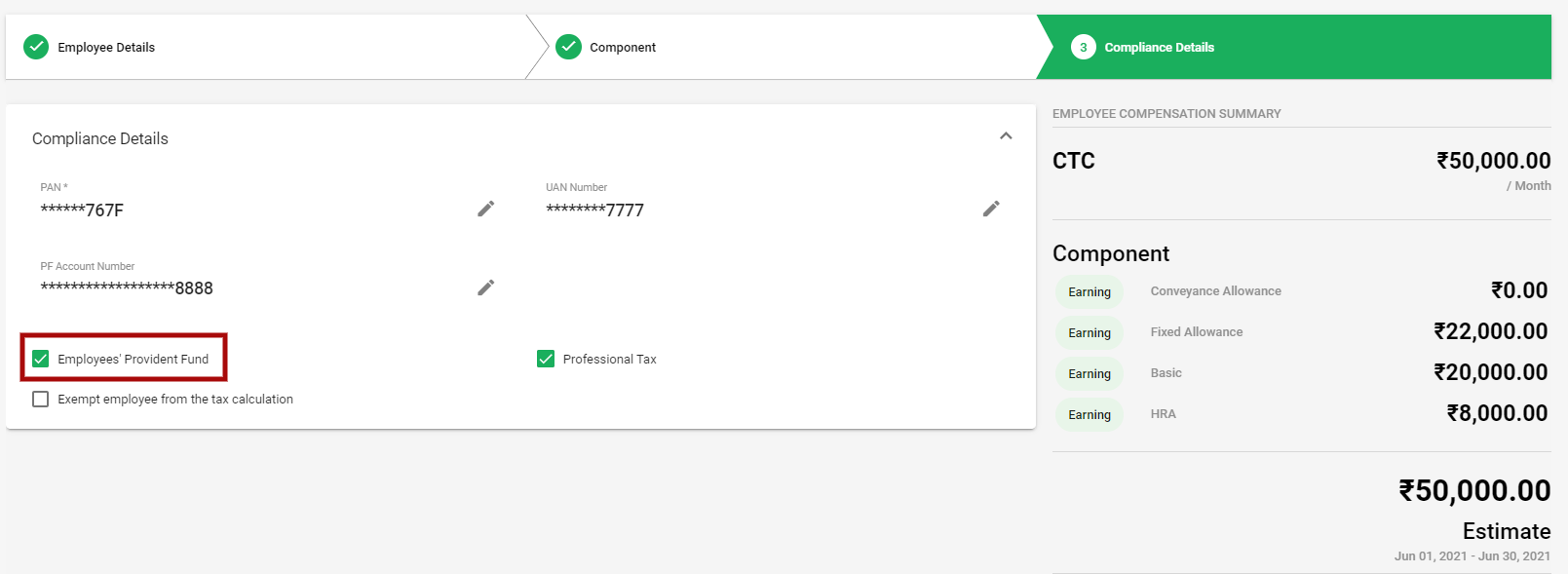

We assure that our PF calculator online works correctly on every occasion. Form 13 is to transfer your old EPF account to your new PF account. On PF contributions including the contributions made from Employees Provident Fund EPF and Voluntary Provident Fund VPF.

The UAN will be the same but the Member ID and the PF account number changes. How to calculate EPF contribution. The interest rate on EPF is reviewed on a yearly basis.

If there is no DA then only basic wage is considered to calculate the EPF monthly contributions. The contribution to the employees provident pension scheme is contributed by the employer only. The employer has to make a contribution of 85 of the employees salary to the PF account.

Your contribution to the EPF account is eligible for getting a deduction of up to Rs 15 lakh under Section 80C of the Income Tax Act. Your basic monthly salary your expected average annual increase in basic salary. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

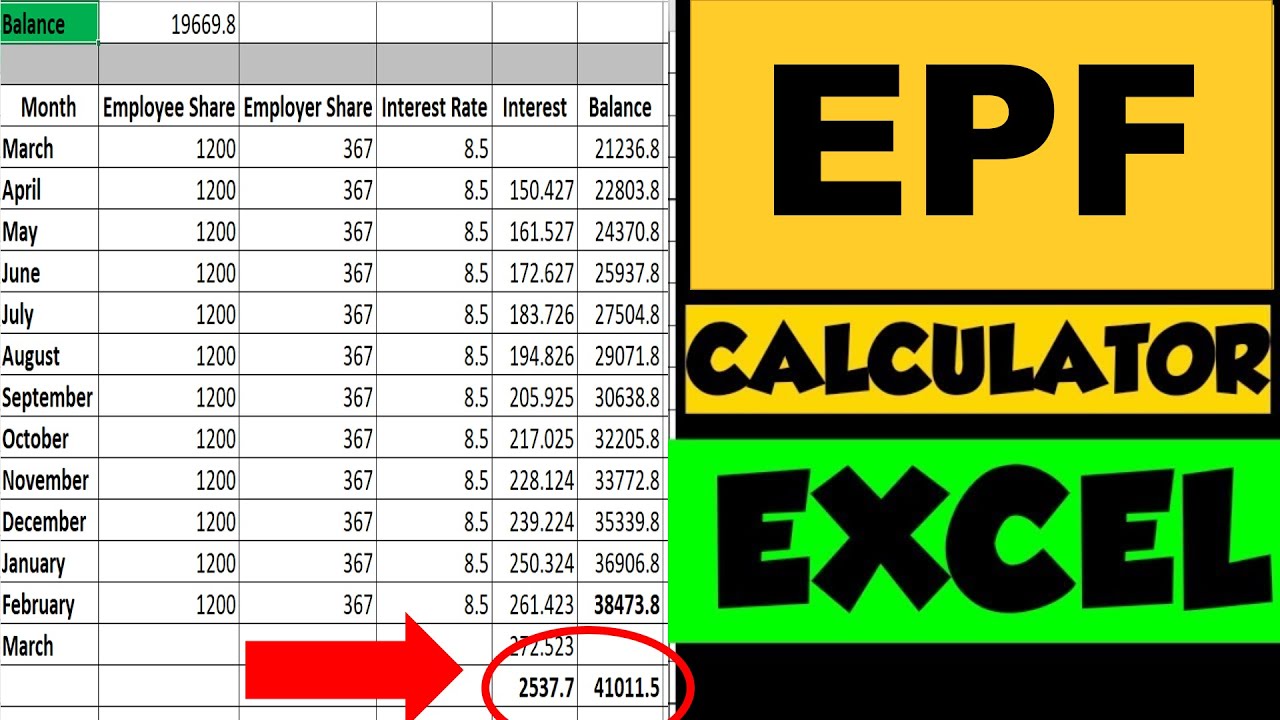

EPF interest is calculated according to the contributions made by the employer and employee. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers.

Interest on the Employees Provident Fund is calculated on the contributions made by the employee as well as the employerContributions made by the employee and the employer equals 12 or 10 includes EPS and EDLI of hisher basic pay plus dearness allowance DA. The total contribution which includes cents shall be rounded to the next ringgit. The full break-up of the percentage of contribution is as seen below.

The interest earned on the EPF Account balance every year is tax-free. ESI Calculation Formula Percentages 2021. Every year the EPF Organization officials are change the EPF Interest Rate.

EPF Interest Rates 2022 2023. Provident Funds which contribute in excess of Rs25 lakh will now be taxable in effect from 1 April 2022. In addition to 12 of employer PFPS contribution the employer also has to pay other charges.

Finally list down the employees details for the current month. How to Calculate Interest on EPF Account Balance 2022. So the total EPF contribution by you and your employer for a month amounts to Rs.

How Much Contribution Is To Be Made Towards The EPS Account. ESI calculated on. However where employers share of EPF contribution is part of the CTC at 12 per cent rate in such a scenario an employee can request hisher employer to keep the contribution at 12 per cent for May June July 2020 instead of paying out the differential 2 per cent amount as salary to the employee.

To check whether your employer is making contributions towards your EPF account or to see your account balance you can use your UAN and log into your EPF account on the EPFO member portal. Since 2020 the default. The employer must pay their employees contributions on or before the 15th of the.

The EPF interest rate for the fiscal year 2022-23 is 810. Payments Exempted From EPF Contribution. The breakup of EPF contribution is different for the employee and the employer.

Know all about PF and EPF benefits.

Epf Calculator Shop 59 Off Ilikepinga Com

Epf Excel Calculator Employee Provident Fund How To Calculate Epf Interest With Epf Interest Rate Youtube

Pf Calculator Best Sale 58 Off Ilikepinga Com

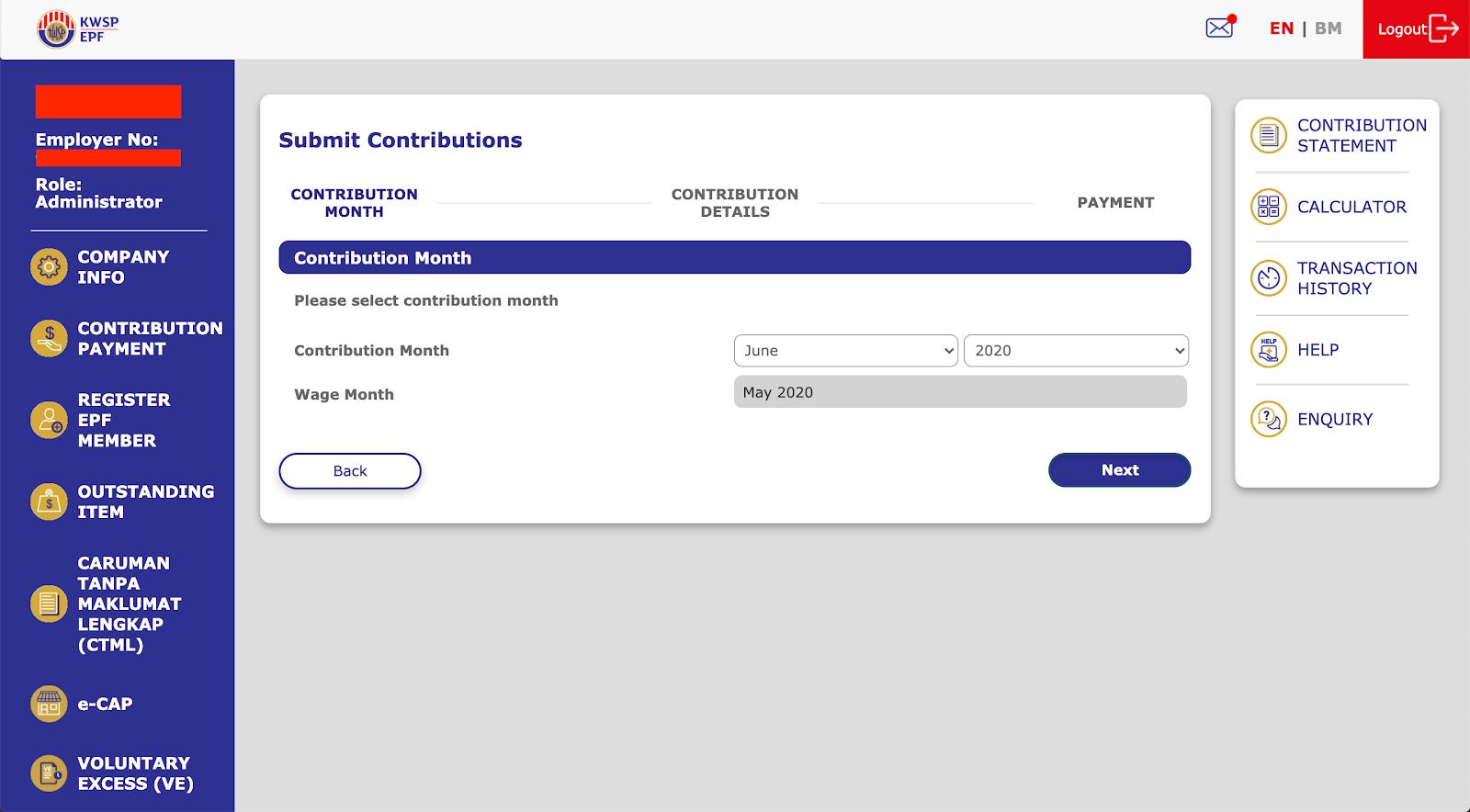

Payroll Panda Sdn Bhd How To Submit The Epf Csv File Through I Akaun

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Pcb Calculator 2022 Epf Calculator Socso Table Free Malaysian Payroll Software

Employee Provident Fund A Complete Guide

How To Calculate Pf Amount In Member Passbook Epf Balance Epf Eps Contribution And Calculation Youtube

Epf Contribution Table 2021 How To Calculate Your And Your Employera S Epf Contribution

How To Calculate Employees Provident Fund Balance And Interest By Emmacooper372 Issuu

Solved From The Following Particulars Calculate Income From Chegg Com

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Epf Calculation How To Calculate You And Your Employer S Epf Contribution Goodreturns

Confluence Mobile Support Wiki

Employees Provident Fund Scheme And Rates

Epf Balance How To Calculate Employees Provident Fund Balance And Interest

Comments

Post a Comment